Have you ever wanted to try something out but decided against it, for fear of it going wrong?” Perhaps such feelings have made you reluctant to invest any of your wealth until now?

Research published by Money Marketing has revealed that an estimated 13 million UK adults are holding £430 billion of “possible investments” in cash deposits.

The study identified several reasons why savers might be scared of investing, including:

- A lack of sufficient knowledge to decide what to invest in (21%)

- Feeling that investing is too complicated (24%)

- Concern that investing is too risky and they could “lose all their money” (43%)

- Needing personalised guidance to help them get started (19%).

If you shy away from investing due to such “investophobia”, read on to discover some helpful tips from the Aspire team for overcoming your nerves.

1. Take a long-term perspective

Focusing on the long-term performance of your portfolio might be helpful if you’re wary of investing because it feels “too risky”.

Short-term fluctuations in the value of your investments may be disconcerting but remember that markets typically recover over the long term.

A recent Schroders review of 148 years of data on the S&P 500, the US stock market index, offers reassuring figures on long-term investing. The research found that the longer a person stayed invested, the less chance they had of losing money.

What’s more, if you look at any long-term index chart using Macrotrends, you’ll see that even when there are fluctuations throughout the years, most stock market indices have seen positive overall growth.

While past results are no guarantees of future returns, this shows how the markets generally bounce back, even if they fall dramatically in the short term.

Additionally, if you reinvest your returns rather than taking them as income, your investments could benefit from compounding returns. Over the long term, this could have a powerful effect on the value of your investments.

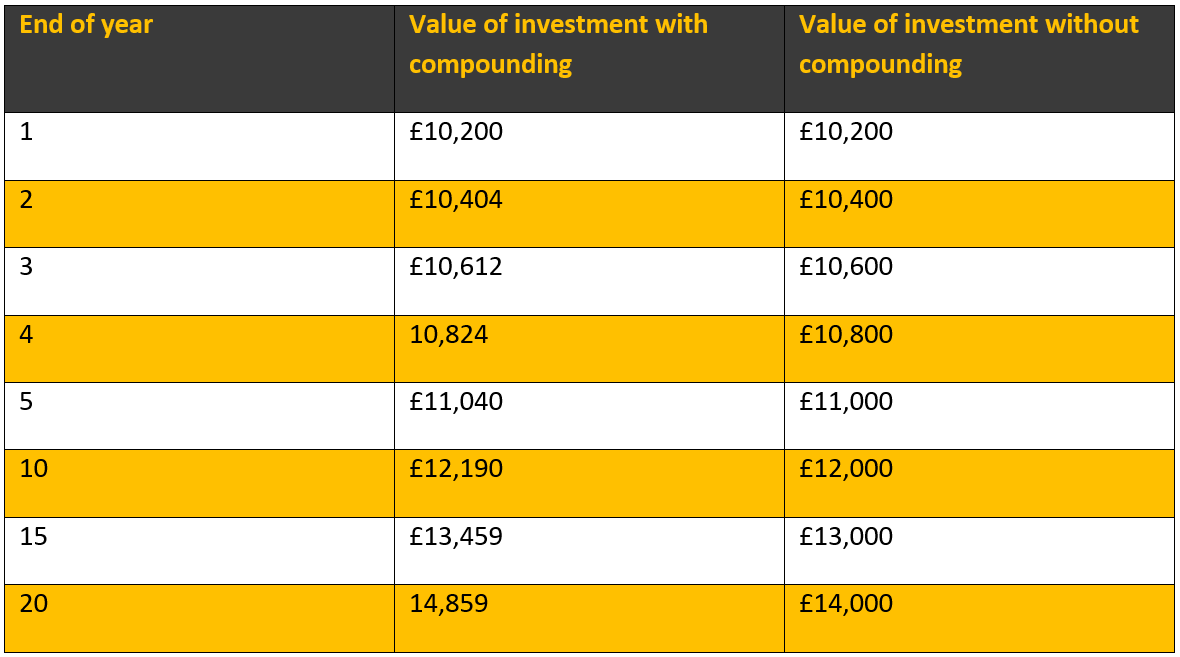

The table below shows how compound returns could grow an investment of £10,000 over 20 years, assuming annual growth of 2%.

Source: Barclays

Of course, the more you invest and the longer you stay invested, the greater the potential for compounding.

So, if a fear of “losing all your money” is holding you back from investing, taking a long-term view could give you the confidence boost you need to get started and hold your nerve during volatile periods.

2. Diversify to balance risk

If you’re scared of investing and worry that you lack relevant knowledge to decide where to put your money, you may be tempted to stick to funds that are familiar to you. For example, you might opt for investments in an industry you know well, or you may decide to focus solely on UK funds.

However, while this may feel comfortable and “safe”, investing in a single type of investment or “asset class” could expose you to a higher level of risk than you might choose.

Instead, diversifying across a range of asset classes, geographical regions, and sectors, could help you balance the risk in your portfolio.

Imagine putting all your money in UK stocks and shares. If the economy in that country hits a bad patch, the total value of your portfolio is likely to fall. Whereas had you spread your wealth across investments in different countries, your gains in other regions might have offset any losses you made on your UK funds.

Indeed, according to figures published by JP Morgan, in 2020 the UK FTSE All-Share index fell by 9.8%. Meanwhile, in the same year, the US S&P 500 index increased in value by 18.4%. So, diversifying your portfolio over these two markets might have helped to protect the overall value of your portfolio.

Of course, if you’re new to investing, you may benefit from some guidance on how to distribute your wealth across asset classes to ensure that you’re balancing risk effectively. That’s where we come in.

3. Seek advice and support from a financial planner

Anything you do for the first time can feel overwhelming and scary. Investing is no different.

Yet, creating a strong investment portfolio could potentially offer an invaluable opportunity to boost your wealth long term and help you progress towards your financial goals.

As such, you might find it beneficial to work with a financial planner who can help you explore your options and overcome your fear of investing.

Get in touch

If you’re apprehensive about investing, we can help you gain the confidence you need to build a balanced investment portfolio that supports your long-term financial goals.

So, if you’re looking for a financial planner in Bristol, please get in touch either by email at helpme@aspirellp.co.uk or by calling 0117 9303510.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Production

Production

of clients believe that working with us has helped or will help them achieve their financial goals

of clients who answered definitively said they would recommend us to their friends, family or colleagues

of clients said they were satisfied with our communications during times of market volatility.