Going through a divorce can be one of the most incredibly painful and stressful life experiences.

The life you had planned and the partner you wanted to live it with have been lost. You’re ultimately faced with realigning your goals and redeveloping your plans going forward.

It can be easy during emotionally charged periods — and when negotiating over issues such as potential custody, property, or savings — to lose sight of the importance of other areas, such as the importance of your pension.

Read on to discover why you shouldn’t neglect pensions in divorce settlements and why they can be incredibly valuable for your long-term plans.

Pension savings might be one of the most valuable assets in your joint estate

Typically, during divorce settlements there is a strong desire among both parties to at least receive their “fair share” of combined assets, which is often at least half of shared property, savings, or investments.

However, one area that is often undervalued during settlement proceedings is pensions. According to PensionsAge, fewer than 1 in 8 divorces in the UK include a formal pensions split.

FTAdviser reports how pensions are regularly overlooked in divorce settlements, as shown by the findings of an important court case study, that showed in:

- 20% of cases, neither party disclosed any pension other than a basic State Pension

- 66% of cases, one or both parties disclosed a pension other than the basic State Pension, but no pension order was made

- Only 14% of cases, a pension sharing order was made.

Many divorcing couples may see their spouse’s pension as their own saving, which is a mistake, especially if one partner has opted to put their own professional lives on hold to support the other.

Any combined earnings during a marriage can be seen to be shared equitably between the spouses. This includes pension earnings by either party, which can be treated as being the joint fruit of their matrimonial partnership and could be divided fairly between both parties during separation.

Remember: it is important to realise the potential value of your combined pension savings.

Pension savings issues disproportionally effect women and it is important to consider gaining your “fair share” during settlements

Unfortunately, despite progress over the last few decades, there remains a very real gender pay gap.

According to Legal & General, the gender pay gap is 14.9% (as of 2022) and older women in particular are affected more than their younger counterparts. The disparity in pension savings is even greater.

It is a problem that disproportionally affects married women, who may have opted to take on traditional child-caring roles within their household and missed out on the workplace pension savings their partners’ have accrued.

According to a study by the Centre for Progressive Policy, women undertake a far greater share of care demands, which can have detrimental effects on their careers and subsequent savings, including:

- One in four (26%) women provide unpaid childcare, which reduces their hours at work

- One in five (20%) women provide unpaid care for an adult, which reduces their hours at work

- One in five (20%) women who provide childcare are prevented from working more hours, even if they wish to do so.

The workplace pension problem is further exacerbated by the gender pay gap, as even if married women continue to work, their pension contributions are likely to be less than their husbands.

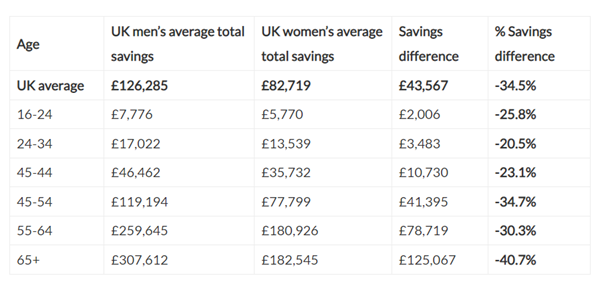

Research from Open Access Government shows that the gap between genders is significantly larger where pensions are concerned — especially later in life — as shown by the table below:

Source: Open Access Government

It is vital that the value of your combined pensions is considered during any divorce proceedings.

If not, one partner could be unfairly left far better off in retirement than the other, even though both parties are entitled to their fair share of the combined value of their pensions.

Working with a financial planner during a divorce settlement can help you stay on track towards meeting your long-term goals

It is important to work with a financial planner, as well as a solicitor, during divorce proceedings, as the assets you emerge from the settlement with are likely to help shape your revised long-term plans.

Working with a financial planner can provide a range of emotional wellbeing benefits, which can be especially valuable during periods of heightened stress and anxiety, such as an ongoing divorce.

According to a study by Royal London, among individuals who sought financial advice:

- 68% felt more in control of their finances

- Only 32% felt anxious about their household finances

- 42% felt confident about their futures.

Additionally, a financial planner can help you deal with any issues arising from pension decisions during a divorce settlement, such as:

- Determining the value of savings you’ll need to reach your personal retirement goals

- Dealing with the value and benefits of specialised pensions, such as defined benefit/final salary schemes

- Ensuring any pension-splitting decisions are dealt with in the most tax-efficient manner and avoid any unnecessary fees or charges

- Setting up a pension to accept a pension share

- Checking that any pension outcomes don’t fall foul of the Lifetime Allowance, and if you are at risk of breaching the amount that steps are taken to avoid it.

It is important that you don’t underestimate the potential value of your pension during a divorce, as it could affect your progress towards your long-term goals and unlocking your desired level of retirement comfort.

Get in touch

Divorce settlements can be complicated and emotionally charged negotiations. It is important that during proceedings you don’t neglect any vital elements that might affect your long-term plans.

If you have any concerns about your current situation during an ongoing divorce, you should email us at helpme@aspirellp.co.uk or call us at 0117 9303510.

Please note

This article is no substitute for financial advice and should not be treated as such. To determine the best course of action for your individual circumstances, please contact us.

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Past performance is not a reliable indicator of future results.

The tax implications of pension withdrawals will be based on your individual circumstances. Thresholds, percentage rates and tax legislation may change in subsequent Finance Acts.

Production

Production

of clients would recommend us to their friends, family or colleagues

believe that working with us has helped them achieve their financial goals

were satisfied with our understanding of their needs and objectives