A good financial plan utilises a wide range of tools to help you generate the growth needed to reach your long-term goals and unlock your dream lifestyle.

Investments are one of these tools. An investing approach can take many forms depending on your goals and tolerance for risk. In terms of a financial plan, these choices are typically aligned with achieving positive outcomes over the long term.

However, when money is concerned, it can be easy to lose sight of the bigger picture and worry about the short term. If markets dip or the greater economy enters a recession, you might feel compelled to change your plans or part with your assets.

It is important to remember to stay calm. Long-term investing is all about patience.

Read on to discover three genuine ways taking a patient approach to your investments can benefit you over the long term.

1. Patience can help avoid making emotionally charged investing decisions influenced by psychological biases

The human brain is susceptible to many psychological biases that can influence decision-making and potentially lead to detrimental choices when it comes to your investments.

Two prominent biases, in terms of investing, are “loss aversion” and “herd behaviour”.

Loss aversion

The theory of “loss aversion” proposes the notion that humans feel the anguish of losses twice as much as the joys of gains.

In investing terms, when faced with potential losses, you may feel compelled to seek out options that reduce them as much as possible.

This can mean when a marketplace sharply dips, you might decide to sell off your investments to protect against further losses, and convert what was initially a paper loss into a definite one.

Opting to sell removes the possibility of your investment rebounding if and when the market eventually recovers, and can hinder your progress towards reaching your long-term goals.

A financial plan is typically developed with periods of downturn in mind, so it may be best to stay patient and ride out any short-term fluctuations.

Herd behaviour

Herd behaviour occurs when investors opt to follow the opinions or decisions of their peers rather than making informed decisions of their own based on evidence and data.

It can be increasingly prevalent during market bubbles or when particular stocks may find themselves overvalued by potential investors. People naturally feel safer when following the collective decision-making of the “herd”.

For example, if your loved ones and professional peers are all investing in a certain type of stock, you may begin to put an inflated emphasis on its value. You may worry about missing out on sizeable profits if your friend’s recommendation comes good.

Some recent examples in which this has occurred and backfired on investors are the dot-com bubble, the 2008 real estate market crash, and in recent years, cryptocurrency and NFTs.

It is important not to rush into chasing short-term trends or fixes. A patient approach in which you reflect on your plans and do the necessary due diligence in terms of research can produce positive outcomes in the long term.

2. Patience can reduce the costs associated with actively investing

Passive investing involves a patient approach to your investments that aims to reduce costs and fees.

Conversely, active investing — as its name implies — requires a hands-on approach with the goal of trying to actively guide a portfolio towards beating the market’s average returns and taking advantage of any short-term price fluctuations. It is an investment method that requires a greater degree of oversight and has the potential to increase associated costs and fees while actively trading stocks.

Meanwhile, passive investing opts to select a carefully prepared, and well-diversified, portfolio designed to achieve long-term growth. This is typically done with a “buy-and-hold” approach with investments retained over long-term periods.

While some active fund managers are able to outperform the market over short-term periods, the vast majority fail to do so in the long run. A study from the Financial Times analysed the performance of 800 investment funds throughout 2022 and found that only a third performed better than passive index trackers.

Remember: markets typically ebb and flow in the short term, but over the long term they are likely to see growth.

For example, IG reports that the FTSE 100 produced median annual returns of 8.43% with dividends reinvested for investors across any 10-year period between 1984 and 2019. If your goals are long term, a patient approach can see you reach your destination with fewer risks and costs.

3. Patience allows you to work on expanding your investments through further diversification rather than simply focusing on short-term fixes

If you are calm and patient, you are likely to be in a better position to carefully assess the state of your portfolio at any given time. A patient approach reduces the time you spend managing your investments and frees you up to focus on potential opportunities.

Diversification is a key part of a successful portfolio and helps navigate any short-term market instability. If you are confident in the long-term performance of your investments, you can spend more time focusing on ways to increase your diversification rather than chasing fixes to short-term problems.

2022 was notably an especially volatile year for global stock markets.

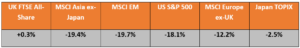

The table below shows the performance of a few of the world’s major stock indices in the year to the end of 2022.

Source: JP Morgan

The data displays just how volatile markets can be, especially during periods of economic turmoil, due to high inflation or rising interest rates. However, it is important to note that despite the majority of the indices seeing annual declines, the UK’s FTSE All-Share actually saw slight growth in 2022.

If you spend less time worrying about market fluctuations, and focus on your long-term goals, you can instead assign your time to developing ways to better diversify your funds, such as across multiple market places.

You may even discover new opportunities through your research, such as traditionally solid and stable investments being valued lower than expected due to market instability.

Get in touch

A patient approach to your investments can benefit you in many ways, both financially and emotionally.

If you have any lingering concerns about short-term market instability, and could benefit from reassurance over your long-term plans, you should email us at helpme@aspirellp.co.uk or call 0117 9303510.

Please note

This article is no substitute for financial advice and should not be treated as such. To determine the best course of action for your individual circumstances, please contact us.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Production

Production

of clients believe that working with us has helped or will help them achieve their financial goals

of clients who answered definitively said they would recommend us to their friends, family or colleagues

of clients said they were satisfied with our communications during times of market volatility.