The UK market had a decent year in 2024, despite ongoing economic uncertainty.

Figures published by the Standard show that the UK’s FTSE 100 gained nearly 6% over the year, having reached several all-time highs, peaking at a close of 8,445.8 points on 15 May – thanks to the gradual easing of the cost of living crisis and cuts to interest rates.

While this performance was somewhat eclipsed by the US S&P 500, which soared by 25% in the same period, 2024 was an encouraging year for UK investors.

Indeed, according to Which?, some experts are predicting that the FTSE 100 could reach 9,000 points by the end of 2025, after it hit another record high on 17 January 2025.

However, while this may be good news for UK investors, beware “home bias” towards UK-based investments that could increase your exposure to risk and limit your returns.

Read on to find out more about home bias and discover three practical tips for preventing it from negatively affecting your investment portfolio.

“Sticking with what you know” could be a sign of home bias

It’s human nature to favour what you know and understand. So, UK stocks and shares may feel more familiar than overseas investments. You may even perceive them as being a “safer” option; one that you feel more confident about.

These could be signs of home bias – concentrating a disproportionately large share of your investments in local assets.

If this strikes a chord, you’re not alone.

An FTAdviser study shows that 25% of the average balanced mode portfolio is made up of UK investments. Yet, the UK only accounts for 3% of global GDP and 4% of global equity and bond markets.

So, you don’t need to put your entire portfolio in the UK market to be affected by home bias – investing just 25% of your wealth in local funds could leave you exposed to a higher level of risk.

Home bias could increase your exposure to risk and limit your investing outlook

Exposure to risk

You’ve no doubt heard the saying, “Don’t put all your eggs in one basket”. It might benefit you to keep this in mind when making investment decisions.

If your portfolio is heavily weighted in favour of domestic stocks and shares, a dip in the UK economy could negatively affect the value of your entire portfolio.

What’s more, the UK may have an inherent “concentration risk” as the largest 10 companies account for 42% of the total market capitalisation. This could mean that if you invest in a UK fund, your returns are reliant on the performance of just a handful of companies.

Missed opportunities

Home bias could not only expose you to higher levels of risk, but it could also mean that you miss out on potentially lucrative overseas investment opportunities.

Remember, that the UK represents a small percentage of the global stock market. It is also dominated by the service sector, which according to UK Parliament figures, accounted for 80% of the UK’s economic output in 2023 – as measured by the total gross value added (GVA).

So, if you rule out investments elsewhere, you might miss out on sectors that play an important role in economic growth, which could limit your investment returns.

Building a diversified portfolio could reduce home bias and lead to greater investment returns

Fortunately, you could overcome home bias by diversifying your investments. In simple terms, this means investing in a range of asset classes across different geographical locations and sectors.

Spreading your wealth across different markets in this way might help you balance risk and increase the potential for higher returns.

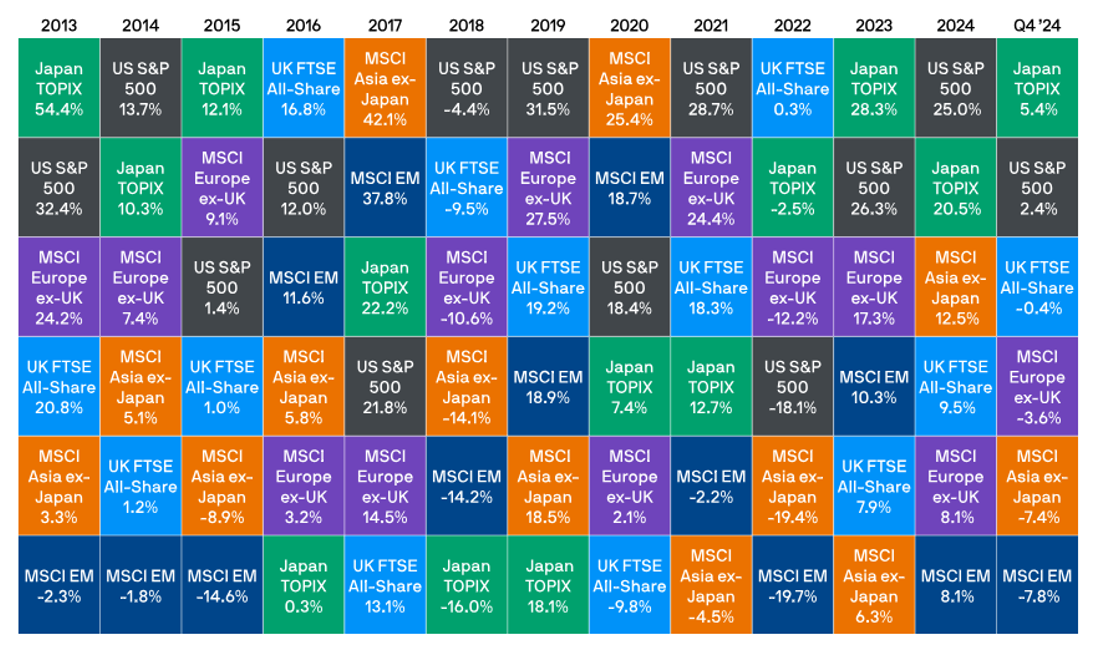

Consider the chart below from JP Morgan, which shows the performance of six geographically diverse stock market indices between 2013 and 2024.

Source: JP Morgan

As you can see, the UK FTSE All-Share Index fell by 9.8% in 2020, while the US S&P 500 index rose in value by 18.4%. So, if you had invested in both markets, your gains in the US could have offset some or all of your losses in the UK.

3 practical tips for avoiding investing home bias

1. Invest in overseas markets

Take a step back and review your portfolio as a whole. How much of your wealth is invested in the UK market?

As shown above, UK equities comprise just 4% of the total global stock market. So, if domestic investments make up more than 4% of your portfolio, this could indicate home bias. As such, you may be exposed to a higher level of risk than you’d like.

A financial planner can help you rebalance your portfolio by identifying overseas investments that align with your financial goals and attitude to risk.

2. Check the composition of your funds

Investment funds usually contain a variety of assets, so they can be a useful way to diversify and spread risk.

However, it’s worth drilling down into the countries and companies represented in your funds, as these might not be as well-diversified as you think.

If your fund contains just a handful of different equities, you could be exposed to concentration risk and home bias.

3. Seek professional advice

Getting the balance in your portfolio right can be a complex task, even for the most seasoned investor.

When your wealth is at stake, it might be hard to view your investments objectively.

A financial planner can review your portfolio and help you overcome home bias by creating a well-diversified portfolio. As an experienced, knowledgeable and impartial adviser, they can also address any uncertainties or worries you may have about stepping out of your comfort zone and investing beyond the UK.

Get in touch

If you think home bias might be affecting your investment decisions, we can help you create a diversified portfolio that aligns with your financial goals.

Please get in touch either by email at helpme@aspirellp.co.uk or by calling 0117 9303510.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

All information is correct at the time of writing and is subject to change in the future. The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Production

Production

of clients believe that working with us has helped or will help them achieve their financial goals

of clients who answered definitively said they would recommend us to their friends, family or colleagues

of clients said they were satisfied with our communications during times of market volatility.