In the UK, investing in property has long been seen as a savvy move that could bring financial rewards in both the short and long term.

According to Mortgage Finance Brokers, 1 in 3 UK adults aspires to property investment, and 60% believe this is a good way to build wealth.

However, there have been significant changes to the buy-to-let market in recent years, which have left some landlords and prospective landlords wondering if property is still a good investment.

Keep reading to learn more about these changes and discover some potential pros and cons of investing in buy-to-let property.

Recent changes to buy-to-let

If you’re considering buy-to-let, there are several recent changes to be aware of which could affect the viability and profitability of your investment.

Increased Stamp Duty surcharge

In her 2024 Autumn Budget, Chancellor Rachel Reeves announced that the buy-to-let Stamp Duty surcharge would increase from 3% to 5% on properties over £40,000. This change took effect from 31 October, and it means that anyone purchasing qualifying properties in addition to their main residence will now pay this higher rate.

However, you won’t pay this surcharge on the entire property price – only on the amount that exceeds the Stamp Duty threshold.

Reduced Stamp Duty threshold

From 1 April 2025, this threshold was reduced from £250,000 to £125,000. This means that fewer investment properties will be exempt from the buy-to-let surcharge.

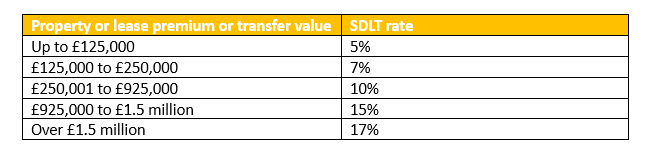

Moreover, Stamp Duty is a progressive tax. As such, the following rates for 2025/26 are payable only on the portion of a property price that falls within each band.

Source: Gov.uk

Note that these rates apply to UK residents only; non-UK residents may face an additional surcharge.

Tighter regulations on energy efficiency

All rental properties in the UK must have an Energy Performance Certificate (EPC), which rates the energy efficiency of the property.

Under current rules, the minimum rating for rental properties is E. However, the government has proposed that all new buy-to-let tenancies should meet a minimum C rating by 2028 and that all rental properties should reach this standard by 2030.

According to LandlordToday, non-compliance could lead to fines of up to £30,000, and some lenders are already clamping down on mortgages for properties that fall short of a C rating. The cost of upgrading to ensure compliance could run from £6,000 to £15,000 for each property.

The Renters’ Rights Bill

This Bill is currently progressing through Parliament. If passed, it is likely to make significant changes to the private rented sector.

These could include banning no-fault evictions, regulating rent increases, and introducing a new “Decent Homes Standard”. All of which could potentially reduce landlords’ flexibility and increase their costs.

Section 24

Before this restriction on tax relief on buy-to-let mortgages was introduced in 2017, landlords could deduct all of their mortgage interest from their rental income and pay tax solely on their profits.

However, this tax relief was gradually reduced between 2017 and 2020, when it was replaced with a 20% tax credit. This change could mean that you face a higher tax bill, making it harder for you to earn a profit from buy-to-let investments.

Abolition of furnished holiday lettings tax relief

As of 6 April 2025, all tax advantages that were previously available to landlords of furnished holiday lettings – such as certain Capital Gains Tax (CGT) reliefs – were removed.

Key benefits of investing in buy-to-let property

While some might say that the buy-to-let market has become more challenging for landlords due to the changes outlined above, there are some benefits to consider.

- Potential for lucrative returns – Figures published by Paragon Bank reveal that the average yields generated by buy-to-let investments reached a 14-year high in April 2025. This is largely due to high demand and a shortage of rental properties.

- A steady rental income – If you invest in properties where there is a consistently high demand, you could build a steady income stream to complement your other earnings, savings, and investments.

- Capital appreciation – While there are no guarantees, your rental property may increase in value over time, giving you a valuable asset to draw on in later life or leave as a legacy to loved ones.

- Portfolio diversification – Spreading your wealth across different types of assets could help to balance the risk in your portfolio. For example, if your investments in tech stocks fall, this potential loss could be offset by the gains you make in a strong property market.

Potential challenges of buy-to-let

No investment comes without risk and buy-to-let presents several unique challenges that are worth considering before you commit to becoming a landlord.

- Interest rate fluctuations – If interest rates rise, you could see your buy-to-let mortgage payments increase, which might make your investment less profitable. This is Money has reported a sharp rise in the number of landlords selling their rental properties, due in part to higher mortgage rates resulting from persistently higher interest rates. In 2025, 17.4% of former rental properties were sold, compared to just 12.2% in 2019.

- Large upfront investment – Lenders typically require a larger deposit for buy-to-let mortgages, compared to residential mortgages – usually 25% of the property’s value. You may also need to pay a Stamp Duty surcharge.

- Less favourable tax rules – Recent changes, such as the introduction of section 24, have made buy-to-let less tax-efficient than it was previously.

- Property management problems – Unless you plan to outsource responsibility for managing your rental properties (which will add to your overheads), you could face time-consuming and demanding maintenance and tenant issues.

- Increased regulation – As highlighted above, the regulations for buy-to-let properties have been tightened in recent years, and this could affect the profitability of your investments. For example, you may need to spend a considerable amount to make your property more energy efficient.

- Ongoing costs – Of course, buying your buy-to-let is just the start of your investment. You’ll also need to budget for ongoing costs, such as maintenance work and paying your mortgage when there are gaps between tenants.

Get in touch

If you want to explore different types of investment, from property to shares and bonds, we’d love to hear from you.

Our financial planners in Bristol can help you create a strategy that aligns with your specific needs and goals. We can also review your portfolio and ensure that it is well-diversified and effectively balances risk.

Email helpme@aspirellp.co.uk or call 0117 9303510.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

All information is correct at the time of writing and is subject to change in the future.

Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

The Financial Conduct Authority does not regulate tax planning.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Your home may be repossessed if you do not keep up repayments on a mortgage or other loans secured on it.

The Financial Conduct Authority does not regulate buy-to-let (pure) and commercial mortgages.

Production

Production

of clients believe that working with us has helped or will help them achieve their financial goals

of clients who answered definitively said they would recommend us to their friends, family or colleagues

of clients said they were satisfied with our communications during times of market volatility.