Building a healthy retirement fund could be key to enjoying the happy and fulfilling retirement you’ve always dreamed of.

However, according to the Guardian, Larry Fink, chief executive of the world’s largest asset management firm, has warned of a looming “retirement crisis” in the US as pension savings fail to keep pace with life expectancies.

In the UK, retirees must also contend with “sticky” inflation that remains stubbornly above the government’s target of 2%. Additionally, a freeze on the Personal Allowance could lead to higher Income Tax bills for many people, which may hit retirees on a fixed income especially hard.

So, you may need to give careful thought to your finances if you want to keep your retirement plans on track.

Read on to find out how you can overcome three of the biggest financial challenges facing retirees in 2024.

1. Factor life expectancy into your financial plan to ensure you can fund a long retirement

Advances in life-extending medical treatments and improved public knowledge about healthy lifestyles mean that you’re likely to live longer than you might have if you were born 50 years ago.

According to figures reported in the Guardian, 1 in 6 people worldwide are expected to be over 65 by 2050, compared to just 1 in 11 in 2019.

And yet, many people are failing to factor their potentially longer life expectancy into their financial planning – or they underestimate how long they might live.

Research by Canada Life has found that on average, people aged 50 and over think they’ll live until around 80 years old, whereas the data shows that men typically live to 84 and women to 87.

This could potentially result in a shortfall in retirement savings – you might spend too much too soon and not be able to enjoy the lifestyle you expect later in life. Indeed, if you access your pension from the normal minimum age of 55 (rising to 57 in 2028), then your retirement may last 30 years or more.

Fortunately, a financial planner can help you plan for your retirement, no matter how long it lasts.

Using advanced tools such as cashflow modelling, a financial planner can provide a clear picture of your retirement income needs – taking into account factors such as your life expectancy, potential fluctuations in your spending during retirement, and inflation. They can also suggest how you might address any potential shortfall, such as increasing your pension contributions for example.

2. Mitigate the impact of inflation on your retirement savings by investing wisely

Inflation is the rate at which the prices of goods and services increase over a given period of time.

In recent years, the headlines have been filled with stories of rising inflation and interest rate hikes. While inflation has begun to fall gradually since it peaked at 11% in 2022, it remains stubbornly above the government target of 2%.

Inflation currently sits at 3.2% in the year to March, a slight decrease from the 3.4% recorded in February, but still uncomfortably higher than 2%.

But how could this affect your retirement savings?

While you may feel that cash savings are a safe, low-risk option, higher inflation rates could potentially reduce the value of your savings in real terms over time. As a result, your retirement income may not last as long as you expect.

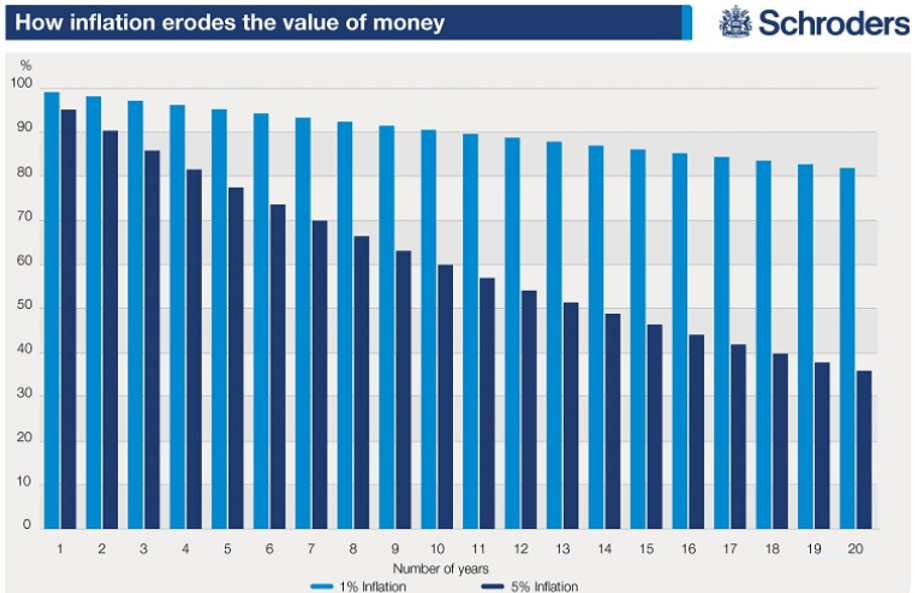

The chart below shows how the real value of £100 could be eroded by inflation over time. If there is a consistent 1% rate of inflation over 20 years, your £100’s spending power would shrink to £82. But with a rate of 5%, you’d only have £36 in real terms after holding your cash for 20 years.

Source: Schroders

So, while it may be wise to keep some cash savings to cover short-term costs and emergencies, you might want to consider investing your long-term savings.

While there is risk involved and you may get back less than you invest initially, investing your money – for example in stocks and shares – has the potential to deliver higher returns than cash savings over time, which could mitigate the effect of inflation.

Indeed, a review of historical data by IG has shown that on average, the FTSE 100 has outperformed inflation – UK stocks delivered annualised returns of 4.9% above inflation over the past 119 years.

This is in large part due to the powerful effect of compound returns – earning returns on both your original investment and on returns you received previously.

Just as a snowball rolling downhill will gradually gather more and more snow, growing bigger and heavier, over time, your investments could grow due to the cumulative effect of compounding returns.

If you’re unsure about how to invest or concerned about taking on risk, you might benefit from speaking to a financial planner. They can help you build a diversified investment portfolio that effectively balances risk and aligns with your long-term goals.

Read more: 10 incredible destinations to add to your bucket list

3. Avoid the State Pension “tax trap” by planning how and when to draw your pensions

At the start of the new tax year on 6 April, the amount retirees can receive from the State Pension increased by 8.5% – the full annual State Pension is now £11,502 a year (2024/25). This was thanks to the State Pension “triple lock”, which sees the amount you receive increase each year in line with inflation, wage growth, or a flat 2.5%.

While this might sound like good news, combined with the freeze on personal tax thresholds and the Personal Allowance – which remains at the 2021/22 rate of £12,570 – the State Pension increase means that many retirees could see their Income Tax bill rise this year.

This is because the State Pension is taxable. So, when added to any other sources of retirement income you may have – such as a workplace pension or property – you could be dragged into a higher Income Tax band.

These tax thresholds have typically risen in line with inflation. So, you’d usually need a significant increase in your income to be pushed into a higher tax band.

However, with both the Personal Allowance and the personal tax thresholds frozen until 2028, a small increase in your income could lead to an increase in your tax rate.

To mitigate the potential impact of these changes on your Income Tax bill, a financial planner can help you devise a strategy for drawing your income from different sources as tax-efficiently as possible.

This might include:

- Taking less from your pension – This could reduce your income for tax purposes. Any funds that remain in your pension pot could also have longer to potentially grow.

- Drawing your tax-free lump sum gradually – Your tax-free lump sum is typically 25% of your pension pot, provided this does not exceed the Lump Sum Allowance of £268,275 (2024/25). Drawing it over multiple years could keep your taxable income below the next tax threshold while still ensuring you can continue to enjoy the same lifestyle.

- Deferring your State Pension – You could reduce your taxable income and increase your future payments. Your State Pension increases by the equivalent of 1% for every five weeks you defer, as long as you defer for at least five weeks.

- Passing on your pension – You could preserve your pension and pass it on to your family tax-efficiently as a pension is generally not considered part of your estate for Inheritance Tax purposes.

- Use money saved in ISAs – ISA withdrawals are free from Income Tax, so this could be a tax-efficient way to boost your retirement income.

If you want to be prepared for the retirement challenges that may lay ahead, a financial planner can help you create a retirement plan that aligns your pensions, savings, and investments with your long-term goals. That way, you could draw your income as tax-efficiently as possible.

Get in touch

If you have further questions about how to create a financial plan that aligns with your retirement goals, we can help.

Please get in touch either by email at helpme@aspirellp.co.uk or by calling 0117 9303510.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Past performance is not a reliable indicator of future performance.

The tax implications of pension withdrawals will be based on your individual circumstances. Thresholds, percentage rates, and tax legislation may change in subsequent Finance Acts.

Workplace pensions are regulated by The Pension Regulator.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Production

Production

of clients believe that working with us has helped or will help them achieve their financial goals

of clients who answered definitively said they would recommend us to their friends, family or colleagues

of clients said they were satisfied with our communications during times of market volatility.