Investing some of your money can be a useful way to build the wealth you need to achieve your long-term goals, be they to retire early or pay for your child’s wedding.

Yet, with so many options available, deciding where to invest might feel daunting.

Property investment is a popular choice for many people. Indeed, research published by FTAdviser has revealed that a third of UK adults aspire to become a buy-to-let landlord.

However, there is generally less awareness and understanding of stock market investments. According to a survey by The Investment Association and Opinium, almost one in five Brits have never heard of a Stocks and Shares ISA.

While putting your money in bricks and mortar may feel like a safe and familiar choice, you could be missing a trick if you don’t consider investing in the stock market. The private bank, Brown Shipley has revealed that 35% of affluent UK adults attribute their success to investing in the markets rather than property.

So, keep reading to learn about the relative pros and cons of investing in both property and stocks.

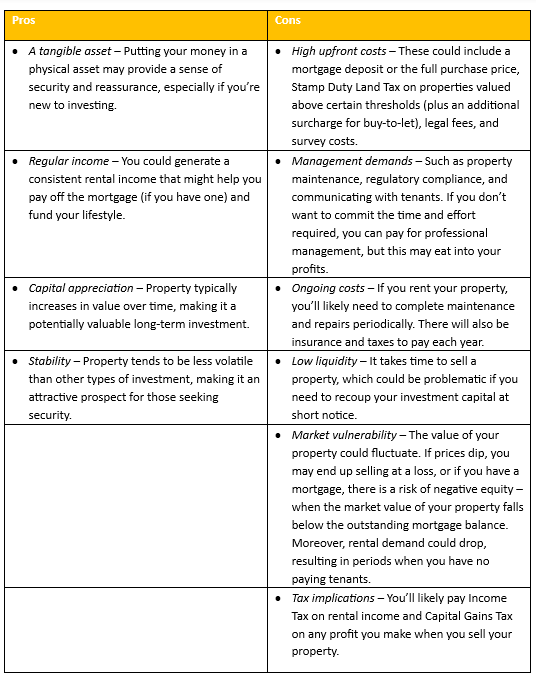

Property investment: The pros and cons

Property investment involves buying real estate to either sell at a profit or generate an income by renting it (“buy-to-let”) – or both.

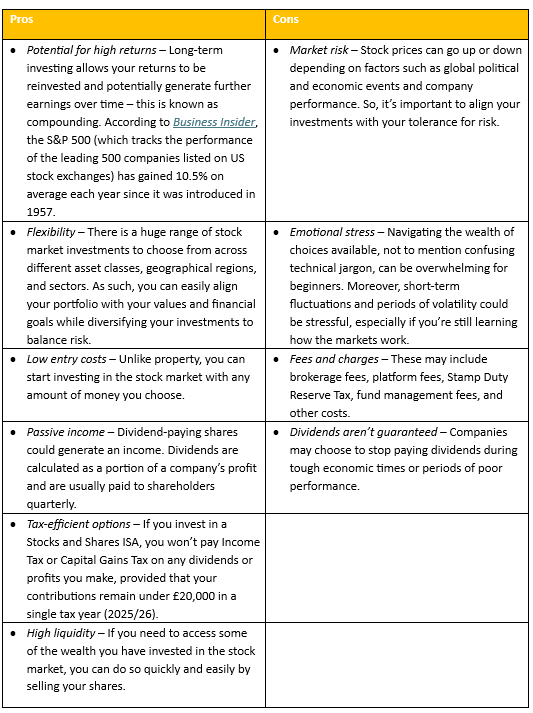

Stock market investment: The pros and cons

Investing in the stock market means buying shares in publicly traded companies with the aim of either growing their value over time or generating an income (dividends) – or both.

Which investment is right for you?

As you can see, there are pros and cons to both property and the stock market when it comes to investing your wealth.

To decide which investment is right for you, it might be helpful to consider:

- Your tolerance for risk

- Your financial goals and time horizon

- How much capital you have to invest now and in the future.

You might benefit from financial advice which could help you explore these factors and understand the different investment options available.

For example, if you’d like to put some of your money in the stock market but feel overwhelmed by choice, our financial planners can provide the ongoing expertise, guidance, and support you need to invest with confidence.

Get in touch

To find out more about how our financial planners in Bristol can help you build an investment portfolio that supports your goals, please get in touch.

Email helpme@aspirellp.co.uk or call 0117 9303510.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

All information is correct at the time of writing and is subject to change in the future.

Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

The Financial Conduct Authority does not regulate tax planning.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Your home may be repossessed if you do not keep up repayments on a mortgage or other loans secured on it.

The Financial Conduct Authority does not regulate buy-to-let (pure) and commercial mortgages.

Production

Production

of clients believe that working with us has helped or will help them achieve their financial goals

of clients who answered definitively said they would recommend us to their friends, family or colleagues

of clients said they were satisfied with our communications during times of market volatility.