Cash is useful for covering short-term expenditure and emergencies. It may also feel like a safe and simple option during difficult economic times, such as the current cost of living crisis.

However, cash savings may not be the most effective strategy for building wealth over the long term, as their purchasing power can be quickly eroded by inflation.

In contrast, investing in the markets could give you a better chance of outpacing inflation, and you may achieve higher returns over time.

Yet, the Financial Conduct Authority (FCA) has found that 61% of adults with £10,000 or more in investable assets hold at least three-quarters in cash.

Read on to find out why you might be holding too much in cash and learn about the potential benefits of investing some of your wealth instead.

Even modest rates of inflation could erode the value of your cash savings over time

Inflation is a measure of the rising cost of goods and services over time. Unless the interest rate for your cash savings account remains consistently above inflation, your money will lose its real value over time. In other words, you’ll be able to buy less with the same amount of money.

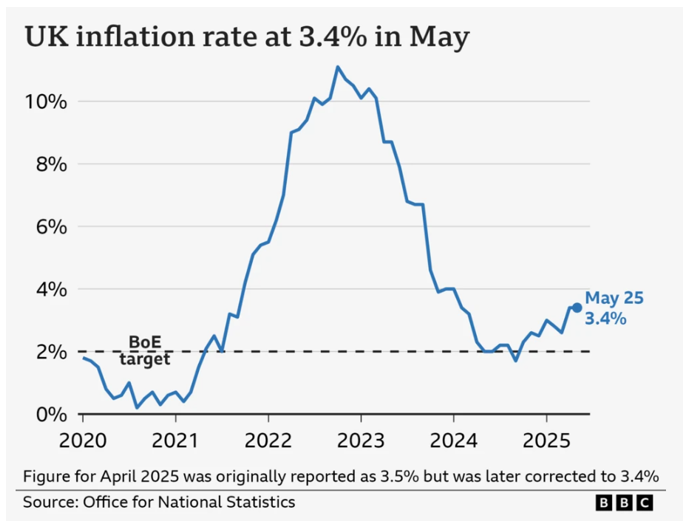

In recent years, the UK has experienced higher-than-average rates of inflation, as measured by the Consumer Prices Index (CPI).

The CPI began to rise sharply in 2021 following the coronavirus outbreak. After peaking at 11.1% in October 2022, inflation has fallen significantly.

However, figures released by the Office for National Statistics (ONS) on 16 July 2025, reveal that UK inflation rose 3.6% in the 12 months to June 2025 – the steepest rise since January 2024.

Moreover, the chart below, published by the BBC, shows that inflation has remained persistently above the Bank of England’s (BoE) 2% target for most of the past four years.

Source: BBC

It’s important to note that even when the rate of inflation decreases, the cost of goods may still be rising – just at a slower pace.

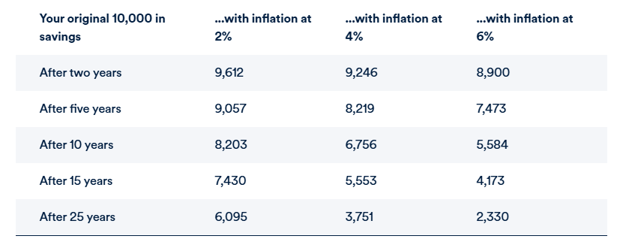

As such, even modest rates of inflation could diminish your cash savings over time.

This chart, published by Schroders shows how different levels of inflation could affect the value of £10,000 cash savings over 25 years.

Source: Schroders. Assumes no cash interest is earned on the original deposit.

As you can see, even if inflation remained at the BoE target of 2%, your £10,000 may fall in real-terms value to just £6,095 over 25 years.

So, if you’re relying on cash savings to grow your wealth and help you progress towards your long-term goals, it might be time to rethink.

Investing could give you a better chance of outpacing inflation and growing your wealth

If you feel anxious about investing, you’re not alone. As demonstrated by the FCA’s research, many wealthy UK adults rely heavily on cash savings.

Moreover, a survey by Barclays found that 2 in 5 respondents said investing is one of life’s toughest decisions. The top concerns reported included a lack of knowledge (44%) and a fear of losing money (41%).

Yet, delaying investing could mean that you miss out on valuable opportunities to grow your wealth.

Outpace inflation

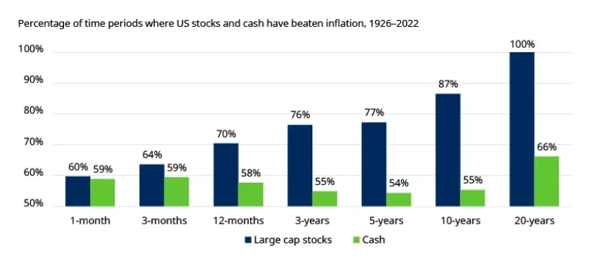

Schroders reviewed almost 100 years of stock market data and found that investments (in the form of large cap stocks) had a higher percentage chance of beating inflation than cash savings.

Source: Schroders

As you can see, cash savings have a 54% to 66% chance of beating inflation, no matter how long you hold them. In contrast, your chance of beating inflation increases the longer you hold investments – reaching 100% at 20 years.

Past performance is no guarantee of future returns, yet these findings highlight the potential benefits of investing for the long term.

Benefit from compounding returns

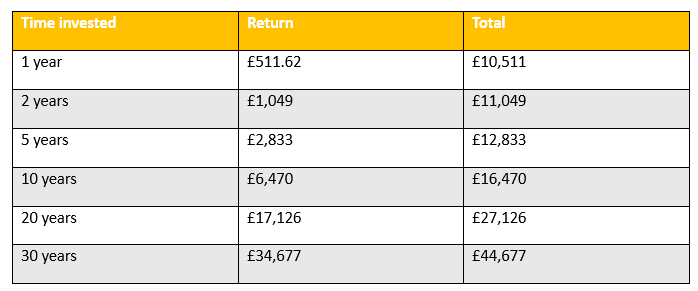

While inflation could erode your cash savings over time, staying invested long term could give your money more time to potentially grow, thanks to the powerful effect of compound returns.

Put simply, compounding means earning returns on both your original investment and on returns you received previously – just like a snowball rolling downhill, gradually growing bigger and bigger as it gathers more snow.

Imagine you make an initial investment of £10,000. The table below shows how this could grow over 30 years, assuming returns of 5% a year and no additional contributions.

Source: (Nutmeg)

In this example, the initial £10,000 investment generated a £34,677 return over 40 years. This shows how compounding can accumulate over time.

So, the sooner you start investing, the more potential your wealth has to grow.

We can help you build a diversified investment portfolio to protect and grow your wealth

If you’re apprehensive about investing, we can help you balance the risk in your portfolio by diversifying across different sectors, regions, and asset classes.

While investing always carries some risk, spreading your wealth across different types of assets could help to limit potential losses. This is because, as one investment falls in value, another may gain.

Our experienced financial planners in Bristol can also offer guidance on balancing your cash savings and investments to ensure that you stay on track to achieve both your short- and long-term goals.

If you’d like to find out more, please get in touch.

Email helpme@aspirellp.co.uk or call 0117 9303510.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

All information is correct at the time of writing and is subject to change in the future.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Production

Production

of clients believe that working with us has helped or will help them achieve their financial goals

of clients who answered definitively said they would recommend us to their friends, family or colleagues

of clients said they were satisfied with our communications during times of market volatility.