Sir Winston Churchill was one of the 20th century’s most significant figures, and 24 January marks the 60th anniversary of his passing.

Churchill is best known as having been the UK’s prime minister during the second world war, from 1940 to 1945, and again, from 1951 to 1955. He was also a military officer and a writer.

Yet you may be surprised to learn that this influential British statesman could also teach you some valuable financial planning lessons.

Read on to find out how three of the former prime minister’s most famous quotes could help you build helpful habits for managing your wealth.

1. Creating a financial plan is the key to achieving your goals

One of Churchill’s most quoted statements is, “He who fails to plan is planning to fail.”

These words provide an important lesson about effective wealth management. Indeed, financial planning could help you clarify your goals and create a roadmap for achieving them.

Whether your priority is to buy a second home in the next 10 years, retire early, or leave a meaningful legacy to your loved ones, crafting a plan that suits your specific circumstances and objectives might be the key to turning your vision into reality.

However, according to research published by the Independent, 59% of adults in the UK have no financial plan in place. Yet, 65% of those with a financial plan reported an increase in their wealth in the past decade, compared to just 38% of those without a plan.

So, if you don’t currently have a strategy for achieving your financial goals and life ambitions, you might want to consider taking Churchill’s advice and start planning for the future.

It’s also important to review your financial plan periodically or if your circumstances change. This could ensure that your goals and your strategy for achieving them, remain relevant to your current needs and preferences.

As such, if it’s been a while since you created your financial plan, it might be worth reviewing and updating it.

Read more: 4 unpredictable events that could mean you’d benefit from a financial review

2. Be proactive about saving and investing for your retirement

Churchill once said, “I never worry about action, but only inaction.”

You may want to take this on board when planning for your retirement.

Accumulating wealth for the later stage of your life may not seem like an immediate priority, especially if your retirement age is many years away.

However, the sooner you start saving and investing for your retirement, the longer you have to build the wealth you need for a comfortable and enjoyable lifestyle after you leave work.

Unfortunately, research by Canada Life has revealed that one in five UK retirees have retirement regrets, including wishing they had:

- Increased their pension savings while they were still working (17%)

- Made lifestyle adjustments while working so they could save more for retirement (12%)

- Retired later than they did so that they could continue building their savings (8%).

Being proactive about saving and investing for your later years could help you avoid such regrets.

For example, it might be worth reviewing your workplace or private pension to check that it aligns with your goals.

According to Standard Life, 1 in 4 UK adults aged over 55 have never checked any of their pensions. Additionally, the Pensions and Lifetime Savings Association has reported that there is £31.1 billion sitting in unclaimed or “lost” pensions.

If you don’t know how much you have in your pension pot, you might find it difficult to assess whether you’re on track to achieve the income you need for your desired retirement lifestyle.

On the other hand, carefully monitoring your pensions could allow you to take action – such as increasing your pension constitutions – if it looks like there may be a financial shortfall when you reach your preferred retirement age.

Additionally, taking control of your pensions could ensure that your wealth is invested in funds that support your long-term goals. As Churchill once said, “Continuous effort is the key to unlocking our potential”.

3. Invest, despite ongoing volatility

Perhaps Churchill’s most well-known quote is, “If you’re going through hell, keep going.” This might be worth bearing in mind when you’re investing.

It’s natural to feel apprehensive about your investments during periods of market volatility. You might instinctively want to cut your losses and sell underperforming stocks and shares.

However, remember that markets can move up as well as down. If you sell your investments when they fall in value, you could turn a potential loss into an actual loss. On the other hand, if you focus on your long-term goals and keep hold of your investments, you may still make a healthy return over time if the markets recover.

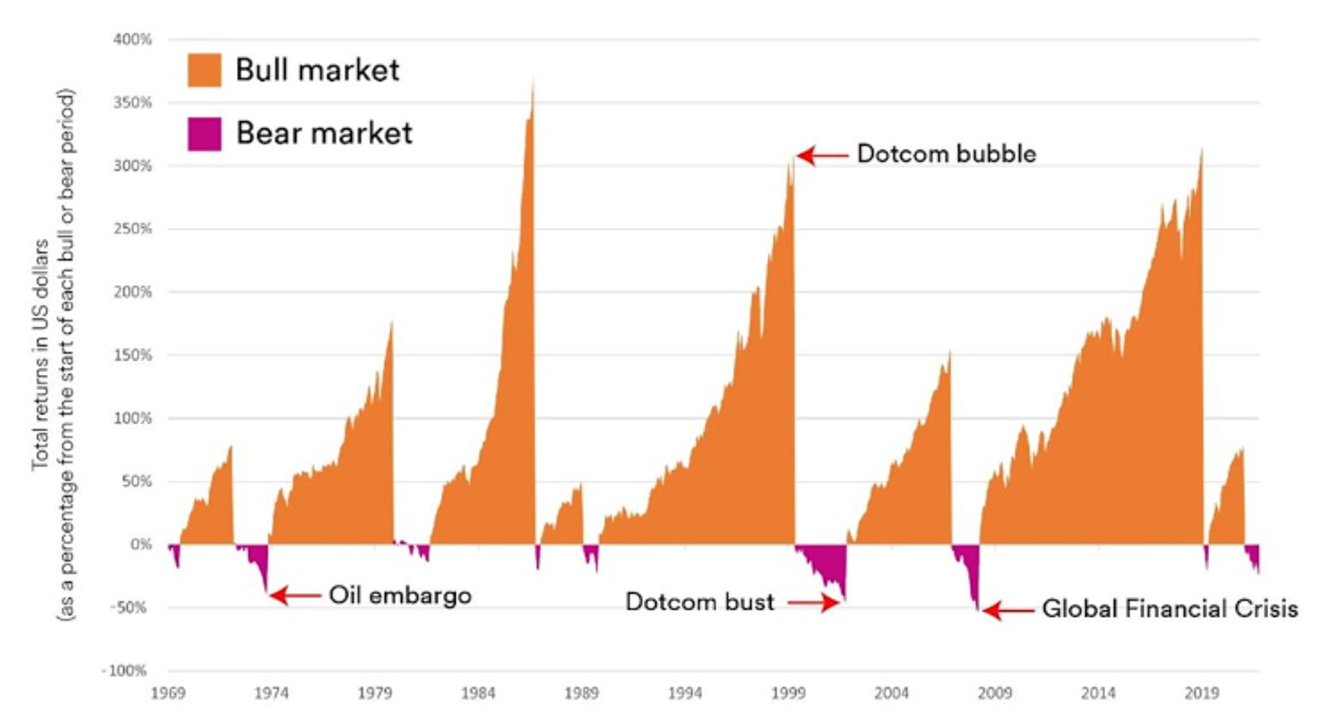

Historically, the markets have tended to recover from even the most significant economic setbacks, such as the 2008 financial crisis and the dot-com bubble, as you can see in the graph below.

Source: Schroders Personal Wealth

So, in the words of Churchill, “Success is not final, failure is not fatal, it is the courage to continue that counts.”

Indeed, remaining invested in a balanced portfolio could allow you to recoup any short-term losses and stay on track to achieve your long-term goals.

Get in touch

If you’re feeling inspired by Sir Winston Churchill’s famous words and would like to take control of your finances in 2025 and beyond, we can help.

If you’re looking for a financial planner in Bristol, please get in touch either by email at helpme@aspirellp.co.uk or by calling 0117 9303510.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Past performance is not a reliable indicator of future performance.

The tax implications of pension withdrawals will be based on your individual circumstances. Thresholds, percentage rates, and tax legislation may change in subsequent Finance Acts.

Workplace pensions are regulated by The Pension Regulator.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Production

Production

of clients believe that working with us has helped or will help them achieve their financial goals

of clients who answered definitively said they would recommend us to their friends, family or colleagues

of clients said they were satisfied with our communications during times of market volatility.